Are Accounts Payable An Expense? Understanding Financial Basics

Accounts Payable Vs Accrued Expenses

Keywords searched by users: Are accounts payable an expense Accounts payable la gì, Accounts payable and accounts receivable are, Accrued expenses là gì, is accounts receivable a revenue or expense, Accrued expenses vs accounts payable, Account receivable, Which of the following are examples of payables of a business, Account payable turnover

Is Accounts Payable An Asset Or Expense?

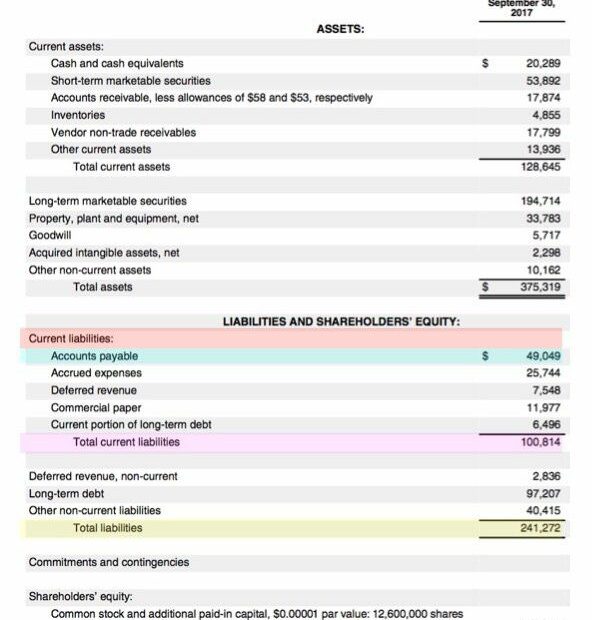

Is accounts payable an asset or expense? Accounts payable is categorized as a current liability on the balance sheet. This means that it represents the amount a company owes to its suppliers for goods or services received but not yet paid for. Instead of being recorded as an asset, accounts payable reflects the company’s short-term obligations. To manage and track these obligations effectively, businesses maintain an accounts payable subsidiary ledger, which contains detailed records of individual transactions, including invoices, due dates, and payment terms. This ledger helps organizations stay organized and ensure timely payments to their creditors, which is crucial for maintaining healthy financial relationships and overall financial stability.

Are Accounts Receivable An Expense?

Is accounts receivable considered an expense? Accounts receivable represents the sum that a customer owes to a seller, making it a valuable asset. This is because it can eventually be converted into cash at a later date. On a balance sheet, accounts receivable is classified as a current asset, primarily because it is typically convertible into cash within a year. This designation helps reflect its liquidity. For instance, if a company makes a sale on November 19, 2022, and expects to collect payment within the next year, the amount owed by the customer would be categorized as accounts receivable until it is received.

Discover 37 Are accounts payable an expense

:max_bytes(150000):strip_icc()/accountspayable.asp-Final-e4e5efa448a94289b6b17189aa72f10e.jpg)

Categories: Top 19 Are Accounts Payable An Expense

See more here: buoitutrung.com

Accounts payable (AP) is a liability, where a company owes money to one or more creditors. Accounts payable is often mistaken for a company’s core operational expenses. However, accounts payable are presented on the company’s balance sheet and the expenses that they represent are on the income statement.Accounts payable is considered a current liability, not an asset, on the balance sheet. Individual transactions should be kept in the accounts payable subsidiary ledger.Accounts receivable is the amount owed to a seller by a customer. As such, it is an asset, since it is convertible to cash on a future date. Accounts receivable is listed as a current asset on the balance sheet, since it is usually convertible into cash in less than one year.

Learn more about the topic Are accounts payable an expense.

- Are Accounts Payable an Expense? – Investopedia

- How Do Accounts Payable Show on the Balance Sheet? – Investopedia

- Is accounts receivable an asset or revenue? – AccountingTools

- Are Expenses Liabilities? How to Tell the Difference – Talus Pay

- Is Accounts Payable an Asset or Liability? (Definitions) – Indeed

- Are Accounts Payable an Expense? – Investopedia

See more: buoitutrung.com/tech