Are Bonds Assets Or Liabilities For Banks: A Financial Perspective

Personal Finance – Assets, Liabilities, \U0026 Equity

Keywords searched by users: Are bonds assets or liabilities for banks are loans assets or liabilities for banks, are government bonds assets or liabilities, are deposits liabilities for banks, are reserves assets or liabilities, are deposits assets or liabilities, are bonds current assets, are treasury bills assets or liabilities, investment in bonds asset or liabilities

Are Bonds An Asset Or Liability For A Bank?

Are bonds considered assets or liabilities for a bank? To answer this question, it’s essential to differentiate between various types of assets. Financial assets encompass a wide range of investments, including cash, stocks, bonds, mutual funds, and bank deposits. Unlike tangible assets such as land or property, financial assets lack inherent physical worth or a physical presence. Instead, they represent ownership or claims on certain monetary values. In the context of a bank, bonds are primarily considered assets. Banks purchase bonds as investments to earn interest income, making them valuable holdings that contribute positively to the bank’s overall financial health. Therefore, when assessing whether bonds are assets or liabilities for a bank, the key distinction lies in their role as income-generating investments rather than as liabilities.

What Are Assets And Liabilities For A Bank?

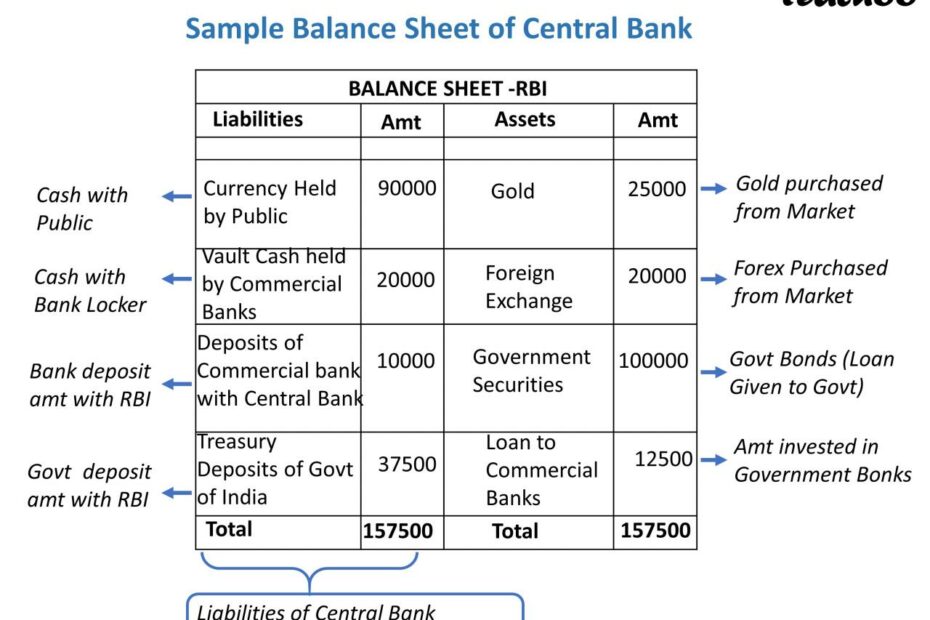

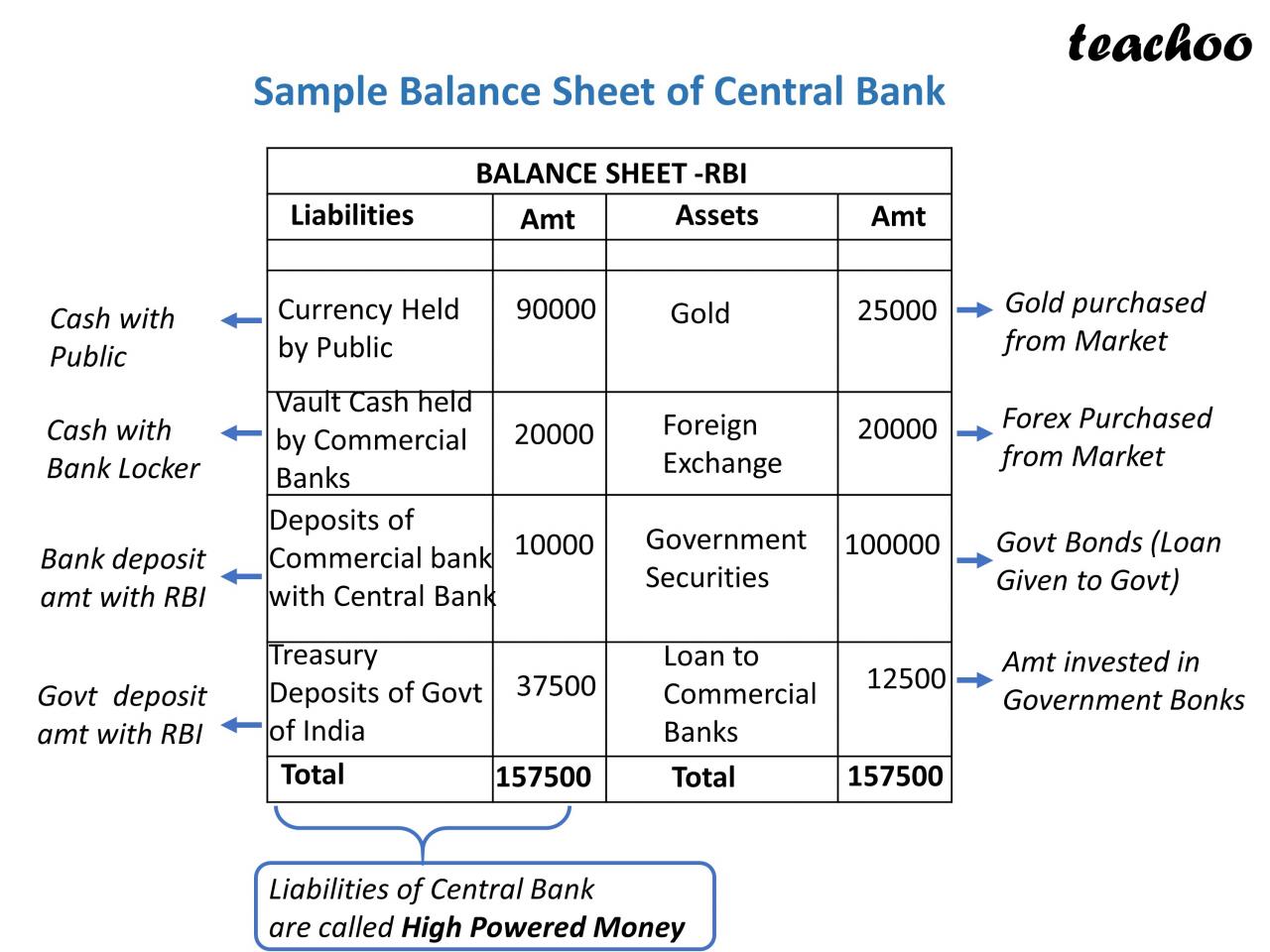

Assets and liabilities are fundamental components of a bank’s financial structure, crucial for understanding its operations. Assets encompass a range of items owned by the bank, such as loans extended to customers, investments in securities, and the reserves held for various purposes. These assets represent the resources and investments that generate income for the bank.

On the flip side, liabilities are obligations that the bank owes to external parties. This includes customer deposits, which are essentially funds held on behalf of customers, and any borrowed funds from other financial institutions. Liabilities signify the bank’s commitments and obligations to repay these borrowed funds and fulfill its depositors’ demands.

To gauge the bank’s overall financial health and stability, it’s essential to consider capital. Capital, often referred to as “net worth,” “equity capital,” or simply “bank equity,” represents the residual interest in the bank’s assets after deducting its liabilities. It serves as a critical buffer against losses and helps ensure the bank can absorb unexpected financial setbacks while continuing to operate safely and effectively. By understanding the interplay between assets, liabilities, and capital, one can gain a more comprehensive grasp of a bank’s financial position and performance.

Discover 27 Are bonds assets or liabilities for banks

:max_bytes(150000):strip_icc()/Asset-Liability-Management_Final-Resized-a324cf826b3c4e0cbce6d97ebba44a57.jpg)

:max_bytes(150000):strip_icc()/bank-capital-final-41cffd89638b4cb388fe85bd0c7983b6.png)

:max_bytes(150000):strip_icc()/trading-assets.asp_final-c4de0872405841f18737c05020d87175.png)

:max_bytes(150000):strip_icc()/Term-Definitions_Financial-Asset-4e356a4b73c448788da4fa8d0708fafd.jpg)

Categories: Summary 82 Are Bonds Assets Or Liabilities For Banks

See more here: buoitutrung.com

These bonds are an asset for banks in the same way that loans are an asset: The bank will receive a stream of payments in the future. In our example, the Safe and Secure Bank holds bonds worth a total value of $4 million.Cash, stocks, bonds, mutual funds, and bank deposits are all are examples of financial assets. Unlike land, property, commodities, or other tangible physical assets, financial assets do not necessarily have inherent physical worth or even a physical form.The assets are items that the bank owns. This includes loans, securities, and reserves. Liabilities are items that the bank owes to someone else, including deposits and bank borrowing from other institutions. Capital is sometimes referred to as “net worth”, “equity capital”, or “bank equity”.

Learn more about the topic Are bonds assets or liabilities for banks.

- Banking Assets and Liabilities | Macroeconomics

- Financial Asset Definition and Liquid vs. Illiquid Types

- Introduction to Bank Balance Sheets Prof. Van Gaasbeck

- Bond: Financial Meaning With Examples and How They Are Priced

- Bank Assets & Liabilities | Overview, Types & Examples – Study.com

- Banks, Government Bonds, and Default: What do the Data Say?

See more: https://buoitutrung.com/tech blog